When you finally retire from federal service, you will receive a lifetime payment (pension) called the FERS Annuity.

How Does OPM Calculate Your Lifetime Payout?

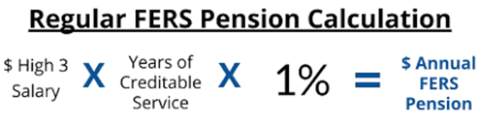

Your FERS Annuity full payment (gross before taxes) is calculated using three known data points.

1.

Your High-3 Salary

2.

Your Total Years of Creditable Service (including military time if a deposit was made)

3.

The OPM FERS Annuity Multiplier

The formula looks like this:

Your High-3 Salary

Your High-3 Salary is the average of the best consecutive thirty-six months of your federal career. It does include Locatity Pay, but it does not include Overseas COLA.

We can help you calculate your Hight Three Salary. Click here to visit with one of our Federal Benefits Specialists.

Your Years of Creditable Service

OPM calculates your creditable service by reviewing your entire federal career, including military time for which you have paid a deposit, Service Academy time, breaks in service, etc. They review your SF-50 and determine your Retirement Service Computation Date (RSCD). Remember that you see your Leave Service Computation Date (LSCD) on your paystub but that is often a much different date than OPM will use to calculate your retirement pay.

If you served in the military with active duty time that is not part of a full retirement, then you can use that time to add service time to your federal career.

If you need help with understanding your military deposit options click here or schedule some time with our team.

Your FERS Annuity Multiplier

Many people who retire at MRA and 30 years of service will have their FERS Annuity calculated using 1% as the multiplier.

Retirees who reach age 62 or older at retirement with at least 20 years of service will have a 10% raise in retirement since your multiplier will be 1.1%.

Special Provision retirees (Law Enforcement, Firefighters, Air Traffic Controllers, etc.) receive 1.7% for the first 20 years of “good time” and 1% for any other years of creditable service.

While there are a few strange modifications to these guidelines for select FERS employees, those differences are rare and typically cover a very small subset of the federal workforce.

If you want the straight scoop from OPM, you can check out their FERS Annuity Handbook here.

How Do You Optimize Your FERS Retirement Benefits?

- Complete your FERS, FEGLI, and FEHB Retirement Package Correctly

- Update your budget well in advance of retirement

- Review and update your Beneficiary Forms – You can do that today!

- Certify your federal service to ensure you know your LSCD and RSCD and what your numbers will look like

- Have a Retirement Income Plan in place before you leave federal service

- Understand the major risks in retirement: taxation, longevity, inflation, and healthcare

Schedule a time to chat with one of our professionals who can help you!