Special Benefit - FERS Employees Who Retire Before The Age of 62

The FERS Special Retirement Supplement is often misunderstood

The FERS Special Retirement Supplement is sometimes called the FERS Supplement or the SRS. This benefit can be a big help to enhance a retiree’s cash flow before they reach age 62. The benefit will cease once you turn 62 and can claim your Social Security benefits.

Remember, claiming Social Security at age 62 is possible but will provide a forever penalized benefit.

Eligibility Rules For The FERS Special Retirement Supplement

A retiree must complete their federal service in the FERS Retirement system to be eligible for the FERS Special Retirement Supplement.

The Civil Service Retirement System (CSRS) system does not provide this kind of financial assistance

To qualify, a FERS retiree must leave federal service with a non-penalized Immediate Retirement to qualify. Those who chose to separate from federal service under the MRA+10 rules are not entitled to this payment.

A retiree must reach their MRA with at least 30 years of creditable service or have at least 20 years of creditable service and retire on or after their 60th birthday but before their 62nd.

Special Provision Employees (ATCs, LEOs, and Firefighters)

Special Provision FERS Employees have unique opportunities for their FERS Special Retirement Supplement. The primary advantage is that if you are fully eligible and retire before your MRA, you will only have an earning test once you reach your MRA. Once you reach MRA, you, like all other FERS employees, are subject to the annual earnings limits published yearly by the Social Security Administration.

Remember that this earnings test applies to your Earned Income, not TSP withdrawals, rental income, etc.

Calculating The FERS Special Retirement Supplement

The calculation for the FERS Supplement is quite complex and time-consuming. The team at Smarter Feds, however, is happy to assist. In fact, everyone who attends a Smarter Feds Retirement Workshop is entitled to receive a no-cost Federal Benefits Report, which will include the exact calculation for your situation. If you are a details person, the specific calculation can be found in the CSRS/FERS Handbook, Chapter 51, Retiree Annuity Supplement.

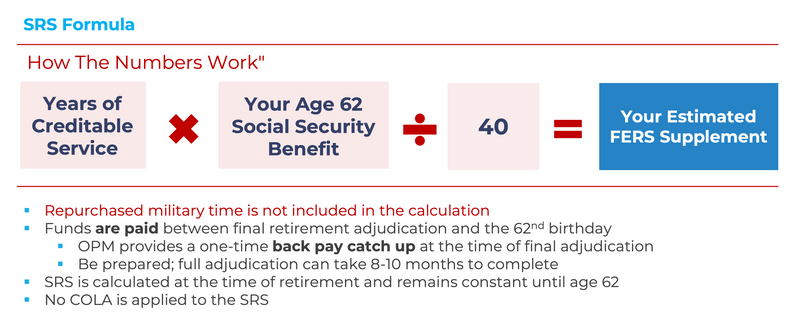

Here is a formula to create a rough estimate for your calculations. Research your Age 62 Social Security benefit at SSA.gov. Then, determine the years of creditable service you will have when you retire would have at your estimated retirement. Divide the years of service by 40 and multiply that by your age 62 Social Security benefit, and you get a rough number to use.

Many FERS retirees have some military time for which they deposited, which counts towards their overall FERS Creditable Service years. That is correct for FERS Annuity calculations but not for the FERS Special Retirement Supplement. OPM will not use the military time you “bought back” to determine your FERS Special Retirement Supplement unless it was performed during a period covered by military leave with pay or leave without pay from civilian service. You can refer to Section 51A2.1-3 of the CSRS / FERS Handbook.

The FERS Special Retirement Supplement is calculated at retirement and will not have any COLAs or increases; it is a constant sum paid until you turn 62 or make too much money

A Possible Change Or Reduction in FERS Special Retirement Supplement Benefits

Once you hit the lower threshold of the Earnings Test, $22,320 in 2024, your FERS Special Retirement Supplement will begin to be reduced in the following year. Just like Social Security, for every $2 you earn above the limit, your FERS Special Retirement Supplement will be reduced by $1. Essentially, but the time you earn $59,520 in 2024 and submit that income to OPM on form RI 92-22 you will have no more FERS Special Retirement Supplement income.

The FERS Special Retirement Supplement Is Taxable

When you file your 1040 each April, you will include your FERS Special Retirement Supplement and FERS Annuity as taxable income.

FERS Special Retirement Supplement Ends When Access To Social Security Begins

The FERS Special Retirement Supplement ends on the last day of the last month of your 61st year.

You can begin to claim your Social Security benefits at age 62, but should you?

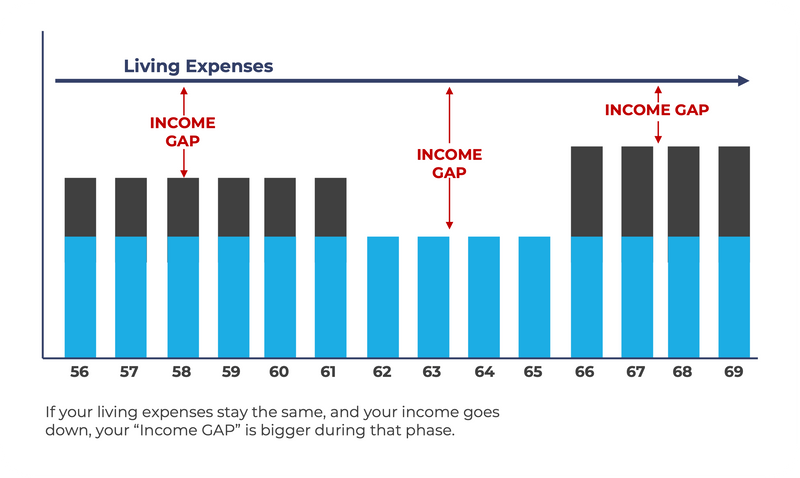

Proper Retirement Income Planning includes Social Security Optimization strategies that consider your health, longevity, need for current cash flow, and overall TSP or other retirement savings balances.

We believe that “Income is the outcome that matters most in retirement.” as such, speaking to one of our Federal Benefits Specialists (link to https://calendly.com/d/2xd-cbk-tv9/srs-talk-to-a-finacial-profesional/?month=2024-03) before you claim Social Security is a great idea to ensure that you are managing each season of life.